If the tax on gasoline is increased, gas stations are most likely to pass most of this increase to the consumer if the demand is:

A. Unitary elastic

B. Very inelastic

C. Slightly elastic

D. Perfectly elastic

B. Very inelastic

You might also like to view...

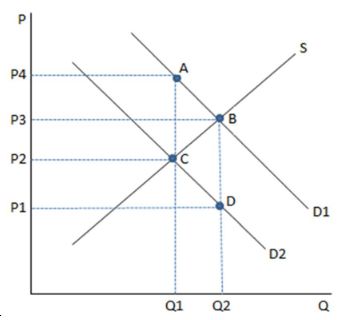

This graph depicts a tax being imposed, causing demand to shift from D1 to D2. The distance AC in the graph shown represents all of the following except the:

A. amount of the tax.

B. difference between what the consumer pays and what the seller receives.

C. "tax wedge."

D. total tax revenue generated for the government by imposing the tax.

What causes employers or employees to behave opportunistically?

In a two-commodity world, balanced growth in a country decreases its willingness to trade because the country becomes self-sufficient in the production of both the goods.

Answer the following statement true (T) or false (F)

You agree to lend $1,000 for one year at a nominal interest rate of 10%. You anticipate that inflation will be 4% over that year. If inflation is instead 3% over that year, which of the following is true?

A) The real interest rate you earn on your money is lower than you expected. B) The purchasing power of the money that will be repaid to you will be lower than you expected. C) The person who borrowed the $1,000 will be worse off as a result of the unanticipated decrease in inflation. D) The real interest rate you earn on your money will be negative.