The notion that lenders must select from a pool of bad credit risks, because the most undesirable borrowers are those that most actively seek out a loan is known as the ________

A) moral hazard problem

B) ornamental torsion problem

C) adverse selection problem

D) asymmetric innovation problem

C

You might also like to view...

A single-price monopolist will produce at the point where

A) MR = 0. B) MR = P. C) MR = MC. D) P = MC.

At Christmastime, individuals choose to hold more cash and fewer deposits to facilitate their Christmas shopping. This condition will

A) increase the money supply, for people will be spending more money. B) have no effect on the money supply because people are just exchanging one form of money (deposits) for another form (cash). C) reduce the money supply because there will be a drain of reserves out of the banks. D) reduce the money supply, for all that cash is spent on Christmas presents.

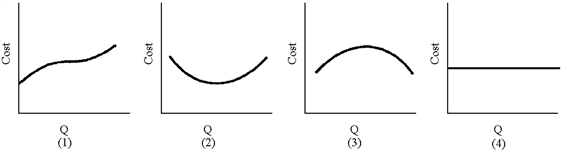

Figure 7-8

Of the graphs in Figure 7-8, which represents fixed cost?

a.

1

b.

2

c.

3

d.

4

A bilateral monopoly means

A) that a monopsonistic employer bargains with two unions. B) that a monopsonistic employer bargains with both an industrial and a craft union. C) that a monopsonistic employer bargains with a monopoly. D) that an industrial union bargains with a two-firm oligopoly.