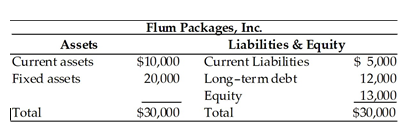

If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital would ________, and the risk of insolvency would ________, respectively. (See Table Below)

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

A) increase; increase

B) decrease; decrease

C) increase; decrease

D) decrease; increase

D) decrease; increase

You might also like to view...

When discussing the types of power used in the coalition-formation process, ________ power emerges from the availability of alternative coalition partners-if there are good alternatives, negotiators can walk away from any unacceptable deal and approach others who may be able and willing to discuss a better deal.

Fill in the blank(s) with the appropriate word(s).

Identify which of the following statements is false.

A. An S election is filed by the corporation by using Form 2553 on or before the due date (without regard to any extensions) for the corporate tax return for the tax year in question. B. An S corporation must file a tax return for any year in which the S corporation is in existence. C. The IRS can grant extensions of time of filing shareholder consents to the S election. D. The election form can be signed by a person authorized to sign the S corporation tax return.

Write the whole number in numerical form: Five hundred fifteen thousand, one

What will be an ideal response?

Fact Pattern 29-1BCall's Farm & Ranch Supply, Inc., uses its inventory as collateral for a loan from Deland County Bank. The bank files a financing statement with the secretary of state in the state in which Call's was chartered. One year later, Call's changes its name to Big C's, Inc.Refer to Fact Pattern 29-1B. To continue the effectiveness of its perfected interest, Deland County Bank must file

A. a continuation statement after the original filing expires. B. an amendment to the financing statement before the period expires. C. a new financing statement immediately. D. a notice of repossession with all interested creditors.