When a partner withdraws from the partnership by selling his or her interest back to the partnership, the remaining partners must pay the withdrawing partner a specified amount from their personal assets

Indicate whether the statement is true or false

False

You might also like to view...

A company has 100,000 shares of common shares outstanding, total assets of $2,500,000, and total stockholders' equity of $1,400,000 . The book value per share of common stock is

a. $0.04; b. $0.07; c. $14.00; d. $25.00; e. none of these

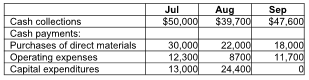

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of August?

Kennison, Inc. has prepared its third quarter budget and provided the following data:

A) $15,000

B) $5,000

C) $10,000

D) $20,000

Jack signed up to run a 26.1 mile marathon even though he had never run such a distance in his life. Thus, for a total of 6 months he summoned the forces inside of him. He woke up at 5:00 am every morning and ran at least six miles. Then on the weekends, he went on a long run of anywhere between 10 to 18 miles. He also changed his diet to include healthier options. Race day came and he completed the marathon despite record heat and strong head winds. Jack’s accomplishment best illustrates which Organizational Behavior Concept?

a. Motivation b. Communication c. Leadership d. Strategic management

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions: Restin, Inc.Los Angeles DivisionBay Area Division Central Valley DivisionRevenues$750,000 $200,000 $235,000 $325,000 Variable operating expenses 410,000 110,000 120,000 180,000 Controllable fixed expenses 120,000 65,000 75,000 70,000 Noncontrollable fixed expenses 60,000 15,000 20,000 25,000 In addition, the company incurred common fixed costs of $18,000Assume that the Los Angeles division increases its promotion expense, a controllable fixed cost, by $10,000. As a result, revenues increased by $50,000. If variable expenses are tied directly to revenues, the new Los Angeles segment contribution margin is:

A. $12,500. B. $50,000. C. $22,500. D. $32,500. E. $60,000.