If the market interest rate is 5% and a bank advertises loans at 12%, the bank will receive

A) no applications.

B) applications from mostly low-risk borrowers.

C) applications from mostly high-risk borrowers.

D) a moral hazard.

C

You might also like to view...

According to the Rule of 70, if a country grows at 2.0 percent per year instead of 1.5 percent per year, how many fewer years will it take to double its level of real GDP?

A) It will take 11.6 years fewer. B) It will take 35 years fewer. C) It will take 58.3 years fewer. D) It will take 20 years fewer. E) It will take 17.9 years fewer.

Investment in safety at the firm level poses a prisoners' dilemma because

A) if each firm plays its dominant strategy, joint profits are maximized. B) if each firm plays its dominant strategy, joint profits are not maximized. C) neither firm has a dominant strategy. D) the Nash equilibrium is not achieved.

How is a tariff different from a quota?

a. A tariff sets a limit on the quantity of a good that may be imported, while a quota is a tax on an import. b. A tariff and a quota are different words for the same thing. c. A tariff is a tax on an import, while a quota set a limit on the quantity of a good that may be imported. d. None of the above are correct.

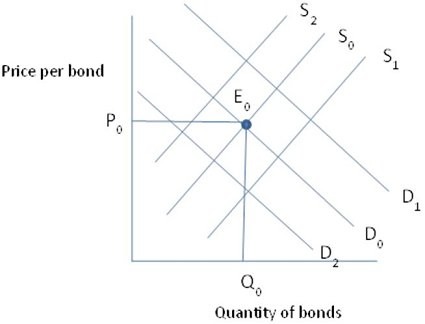

The market for bonds is initially described by the supply of bonds - S0, and the demand for bonds - D0, with the equilibrium price and quantity being P0 and Q0. An increase in the nation's wealth, all else constant, would cause the

A. Bond supply curve to shift to S1. B. Bond supply curve to shift to S2. C. Bond demand curve to shift to D1. D. Bond demand curve to shift to D2.