According to the Rule of 70, if a country grows at 2.0 percent per year instead of 1.5 percent per year, how many fewer years will it take to double its level of real GDP?

A) It will take 11.6 years fewer.

B) It will take 35 years fewer.

C) It will take 58.3 years fewer.

D) It will take 20 years fewer.

E) It will take 17.9 years fewer.

A

You might also like to view...

Which of the following explains why the demand for loanable funds is negatively related to the real interest rate?

A) A lower real interest rate makes more investment projects profitable. B) Consumers are willing to spend less and hence save more at higher real interest rates. C) Interest rate flexibility in financial markets assures an equilibrium in which saving equals investment. D) All of the above are reasons why the demand for loanable funds is negatively related to the real interest rate.

Recently, the U.S. national income accounts have switched to calling government purchases

a. government spending and transfer payments. b. transfer payments and gross investment by government. c. government consumption expenditure and gross investment. d. government wages, salaries, and investment expenditure.

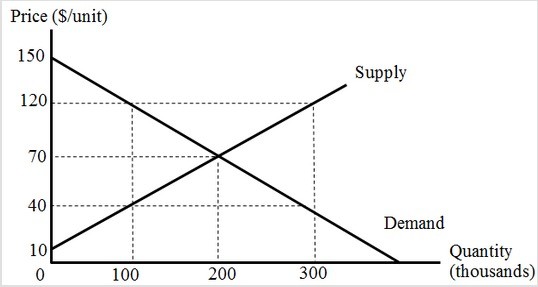

Refer to Figure 2.1 below. At a price of $70, the producer surplus equals

A. $15,000,000. B. $6,000,000. C. $8,000,000. D. $30,000,000.

The balance of payments constraint refers to the limits on:

A. exchange rate policy imposed by flexible exchange rates. B. currency convertibility observed in most developing countries. C. domestic macroeconomic policy, arising from a shortage of international reserves. D. macroeconomic policy resulting from IMF conditionality.