Which of the following acts required that financial derivatives be traded in established, regulated markets?

a. Glass-Steagall Banking Act

b. Gramm-Leach-Bliley Financial Services Modernization Act

c. Dodd-Frank Wall Street Reform and Consumer Protection Act

d. Celler-Kefauver Financial Reform Act

c

You might also like to view...

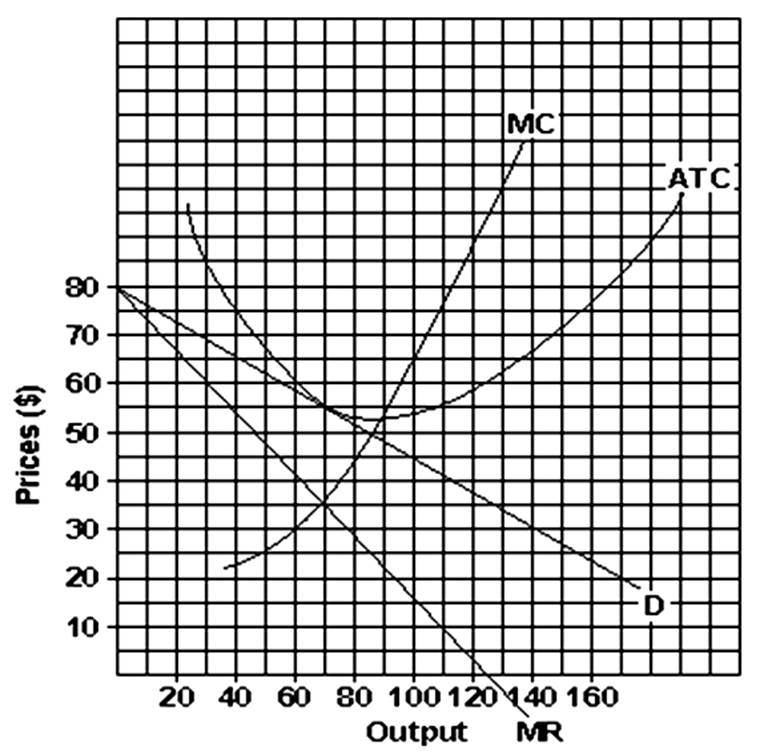

If a marginal cost pricing rule is imposed on the firm in the figure above, the consumer surplus will be

A) zero. B) $800. C) $400. D) $200.

The Services sector has been steadily rising in relative importance in GDP of the United States, as well as elsewhere around the world. Since "services" have been identified as "non-tradable"

(e.g., it is difficult to export haircuts), it may be argued that this trend will likely slow the rapid growth in international trade. Discuss.

_____ Act set forth a list of "employers' rights."

A. Both the Taft-Hartley and the National Labor Relations B. Neither the Taft-Hartley nor the National Labor Relations C. The Taft-Hartley, but not the National Labor Relations D. The AFL, but not the Knights of Labor

This profit-maximizing (loss-minimizing) firm charges a price of _______.

A. $35

B. $40

C. $45

D. $55