The Services sector has been steadily rising in relative importance in GDP of the United States, as well as elsewhere around the world. Since "services" have been identified as "non-tradable"

(e.g., it is difficult to export haircuts), it may be argued that this trend will likely slow the rapid growth in international trade. Discuss.

This argument stands on questionable logical foundations. The past half century has seen a steady growth in the absolute and relative importance of international trade. This trend has been reversed only by global conflicts, i.e. the two World Wars. This trend has remained steady and robust despite major compositional shifts (e.g., from primary to manufacturing), and location shifts (e.g., the sudden rise of NICs as significant group of exporters). The trend will probably continue into the reasonable future, fueled by both super-regional preferential trade regions and a growing impact of the multilateral forces, represented institutionally by the World Trade Organization (WTO)—as illustrated by the recent abolishment of the epitome cartelized trade, the world trade in textiles. Driven by technology—especially in the areas of communication and transportation—a reversal of the growing trade trend is not likely in the near future. In any case, many "services" are in fact quite tradable. Examples would be financial services, long-distance teaching, "help-desk" outsourcing, consulting and management services and others. In fact, when a tourist gets a haircut, we see that even haircuts become a "tradable" service.

You might also like to view...

The depth of the 1981-1982 recession caused the Fed to abandon its experiment in targeting ________ and move to what now appears to be ________ growth rule

A) money growth, an interest rate B) money growth, a real GDP growth C) money growth, an unemployment rate D) interest rates, a high-powered money growth E) interest rates, a nominal GDP growth

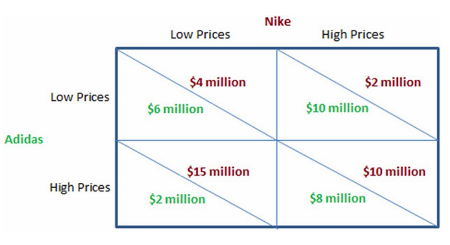

According to the figure shown, Adidas:

A. should charge a low price, regardless of what Nike chooses to do.

B. should charge a high price, regardless of what Nike chooses to do.

C. does not have a dominant strategy.

D. should take the first-mover advantage and charge a low price.

If we want to gauge how much the income tax system distorts incentives, we should use the

a. average tax rate. b. ability-to-pay principle. c. total tax revenue collected. d. marginal tax rate.

If demand is highly elastic and supply shifts to the right:

A. price will rise significantly as will quantity. B. price and quantity will hardly change at all. C. price will hardly change at all; quantity will rise significantly. D. price will fall significantly; quantity hardly changes at all.