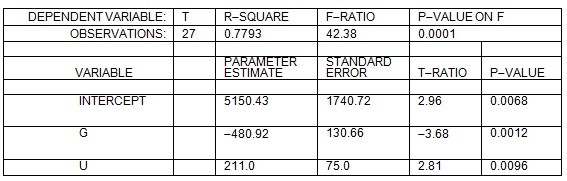

A firm is experiencing theft problems at its warehouse. A consultant to the firm believes that the dollar loss from theft each week (T) depends on the number of security guards (G) and on the unemployment rate in the county where the warehouse is located (U measured as a percent). In order to test this hypothesis, the consultant estimated the regression equation T = a + bG + cU and obtained the following results:  Based on the above information, a one percent increase in the level of unemployment in the county results in an increase in losses due to theft of ________ more losses per week.

Based on the above information, a one percent increase in the level of unemployment in the county results in an increase in losses due to theft of ________ more losses per week.

A. $460

B. $75

C. $211

D. $280

Answer: C

You might also like to view...

An economy with an expansionary gap will, in the absence of stabilization policy, eventually experience a(n) ________ in the inflation rate, leading to a(n) ________ in output.

A. decrease; increase B. increase; increase C. decrease; decrease D. increase; decrease

If the monetary multiplier is 6, then the reserve requirement must be

A. 0.6. B. 0.167. C. 1.67. D. 0.06.

Suppose a firm can only vary the quantity of labor hired in the short run. An increase in the cost of capital will

A) increase the firm's marginal cost. B) decrease the firm's marginal cost. C) have no effect on the firm's marginal cost. D) More information is needed to answer the question.

It does not matter whether a tax is levied on the buyers or the sellers of a good because

a. sellers always bear the full burden of the tax. b. buyers always bear the full burden of the tax. c. buyers and sellers will share the burden of the tax. d. None of the above is correct; the incidence of the tax does depend on whether the buyers or the sellers are required to pay the tax.