Suppose Lefty has utility characterized by the equation: U l = 3I 1/2 , where I is income. In addition, Righty has utility characterized by the equation: U r = 4I 1/2 , where I is income.

(A) If each had $100,000, which one would have the higher level of utility?

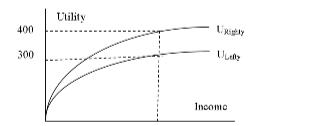

(B) Illustrate Lefty's and Right's utility functions.

(C) What equal amount of income could we give to both that would also give them the same

level of utility?

(A) Lefty's utility would be 300. Righty's would be 400.

(B) $ 100,000

(C) The only level that would work for both is 0.

You might also like to view...

Using a good as a medium of exchange confers the benefit that

A) the need to quote so many prices in trade is reduced. B) the need for a double coincidence of wants is greatly increased. C) the need for specialization is reduced. D) transactions costs are increased, but they now may be paid in money terms.

All of the following are deficit items in the balance of payments accounts EXCEPT

A) U.S. residents purchases of gold from foreign residents. B) U.S. tourists spending funds in Europe. C) exports of merchandise. D) U.S. purchases of foreign companies' stocks and bonds.

Which of the following would NOT be a cause for an increased American demand for the Mexican peso?

A) The United States having lower interest rates than Mexico B) Increased American demand for Mexican goods C) The expectation by speculators that the value of the peso is edging up D) Greater economic growth in the United States

Paul Romer's theory of economic growth differs from traditional theories in that

A. Romer argues that investment in capital goods is not important in encouraging growth while investment in human capital is, whereas traditional theorists emphasize both human and physical capital. B. Romer argues an investment-knowledge cycle allows a one-time increase in investment to permanently increase a country's growth rate, while traditional theory argued such an investment would have only a short-term effect. C. Romer argues that investment in human capital always occurs before investment in physical capital, while traditional theories emphasize the priority of physical capital. D. Romer argues an investment-knowledge cycle can exist, but requires constant increases in investment rates, while traditional theories argue that investment rates can be constant.