As the tax rate increases, the government spending multiplier

A. could either increase or decrease depending on the value of the MPC.

B. increases.

C. does not change.

D. decreases.

Answer: D

You might also like to view...

The effectiveness lag is

A) the time it takes for policy makers to obtain data indicating what is happening in the economy. B) the time it takes for policy makers to be sure of what the data are signaling about the future course of the economy. C) the time it takes to pass legislation to implement a particular policy. D) the time it takes for policy makers to change policy instruments once they have decided on the new policy. E) the time it takes for the policy actually to have an impact on the economy.

During the 1980s, the top marginal tax rate on personal income was reduced from 70 percent to less than 40 percent and it has remained below 40 percent since that time. In recent years, the share of the personal income tax collected from the top one-half of one percent of earners has

a. fallen sharply from the level of years prior to 1981. b. increased sharply during the Clinton administration, but declined substantially during the administration of George W. Bush. c. been virtually unchanged from the level of years prior to 1981. d. increased substantially from the level of years prior to 1981.

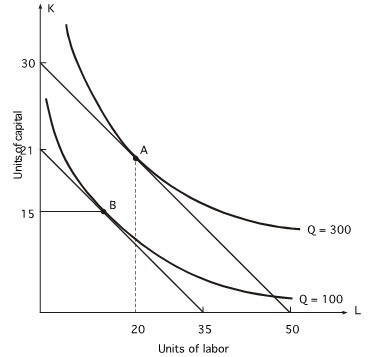

Refer to the following graph. The price of labor is $3 per unit: What is the price per unit of capital?

What is the price per unit of capital?

A. $2.00 B. $5.00 C. $1.50 D. $2.10

If the Fed has a strong preference for stable prices relative to output, it responds to a price ________ with a ________ increase in the interest rate.

A. increase; large B. decrease; large C. decrease; small D. increase; small