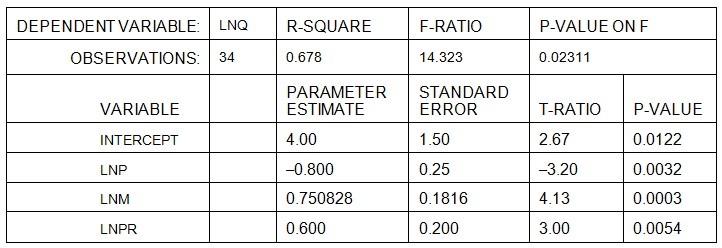

Build-Right Concrete Products produces specialty cement used in construction of highways. Build-Right is a price-setting firm and estimates the demand for its cement by the State Highway Department using a demand function in the nonlinear form:Q = aPbMc where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

height="198" width="577" />Given the above, if Build-Right decides to charge the State Highway Department $55 per yard for its cement when tax revenues per capita are $3,200 and the price of asphalt is $35 per yard, the expected quantity demanded is

A. 6,000 yards of cement.

B. 1,000 yards of cement.

C. 2,000 yards of cement.

D. 8,000 yards of cement.

E. 4,000 yards of cement.

Answer: D

You might also like to view...

Under conditions of perfect competition, an individual producer

a. always maximizes output. b. operates where MR equals MC. c. never suffers a loss. d. operates where MR is greater than MC.

GDP uses the market value of goods and services because it:

A. provides a common valuation that allows us to compare one economy to another. B. provides the opportunity to compare lists of outputs to see who produced more. C. is the only data that can be gathered about goods and services. D. markets are the only way to value goods and services.

Under the Bretton Woods system, a country with a balance of payments deficit

a. could get loans from the U.S. government. b. could devalue if deflationary policies failed to eliminate the deficit. c. was not allowed to devalue under any circumstance. d. was required to devalue its currency immediately.

If taxable income is rising and if the marginal tax rate is greater than the average tax rate, then

A. the average tax rate must be rising. B. the average tax rate must be falling. C. the average tax rate may be either rising or falling. D. the tax is regressive.