Explain how income and substitution effects alter the saving behavior of households

What will be an ideal response?

When the interest rate rises, the opportunity cost of spending income rises and therefore, individuals will be more likely to save. This is the substitution effect. However, because the interest rate increase makes households better off, they want to purchase more normal goods and save less. This is the income effect.

You might also like to view...

The Department of Justice generally

a. is not involved in merger policy. b. opposes horizontal mergers but permits conglomerate mergers. c. opposes only mergers that might reduce competition. d. opposes mergers whose apparent motive is obtaining economies of scale.

The SRAS curve is upward sloping, there is a liquidity trap, and investment spending is sensitive to changes in the interest rate. According to the monetarist transmission mechanism, if the money supply increases the AD curve __________ and the price level __________

A) does not change; does not change B) shifts to the left; falls C) shifts to the right; rises D) does not change; rises E) none of the above

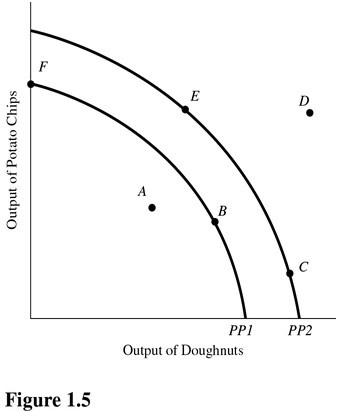

Using Figure 1.5, if an economy is currently producing on PP2, which of the following would shift the production possibilities curve toward PP1?

Using Figure 1.5, if an economy is currently producing on PP2, which of the following would shift the production possibilities curve toward PP1?

A. A decrease in the amount of capital available. B. A decrease in the level of unemployment towards the normal level. C. An increase in the quantity of labor available. D. An advancement in technology.

________ is buying a country's currency spot and selling that country's currency forward, to make a net profit from the combination of the difference in interest rates between countries and the forward premium on the country's currency.

A. Uncovered interest parity B. Covered interest arbitrage C. Uncovered interest arbitrage D. Covered interest parity