What effect would taxation have on real consumption spending when government spending is autonomous?

A) Taxation reduces real consumption spending.

B) Taxation increases real consumption spending.

C) Taxation causes both real consumption spending and planned real saving to increase.

D) None of the above is correct.

Answer: A) Taxation reduces real consumption spending.

You might also like to view...

Assume that a company has several male workers who do not give their full cooperation to female supervisors making them less effective as supervisors. Economists would refer to this type of situation as ____

a. statistical discrimination b. discrimination by fellow workers c. discrimination by employers d. non-discrimination

A Decrease in price will result in an increase in total revenue if:

a. the percentage change in quantity demanded is less than the percentage change in price. b. the percentage change in quantity demanded is greater than the percentage change in price. c. demand is inelastic. d. the consumer is operating along a linear demand curve at a point at which the price is very low and the quantity demanded is very high.

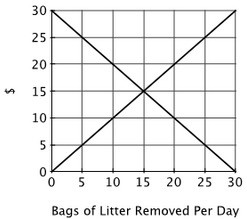

This graph shows the marginal cost and marginal benefit associated with roadside litter clean up. Assume that the marginal benefit curve and marginal cost curve each have their usual slope. The socially optimal number of bags of litter removed from the roadside each day is:

The socially optimal number of bags of litter removed from the roadside each day is:

A. 15. B. 10. C. 20. D. 30.

Consider an output beyond the minimum point of a firm’s short run average total cost curve. At this level of output the firm can use its _______ input at a lower average cost but only by using its _______ input at a higher average cost.

A) fixed capital; variable labor B) variable labor; fixed capital C) variable capital; fixed labor D) fixed labor; variable capital