On December 31 of last year, Alex and Jackson become equal partners in the AJ Partnership with assets having a tax basis and FMV of $120,000. The partnership, which deals in securities, had no liabilities at the end of last year. In January of this year, Franklin contributes his investment securities with an FMV of $60,000 (purchased two years ago at a cost of $45,000) to become an equal partner

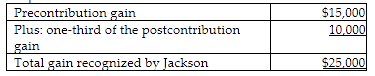

in the new AJF Partnership. The securities, which are inventory to the partnership, are sold on December 15 of the current year for $90,000. What amount and character of gain from the sale of these securities should be allocated to Franklin?

A) $10,000 ordinary income

B) $15,000 capital gain and $10,000 ordinary income

C) $25,000 capital gain

D) $25,000 ordinary income

D) $25,000 ordinary income

There is no special provision to preserve the capital gain character for Jackson, so the entire gain is ordinary income.

You might also like to view...

Which of the following is an accurate conclusion from the recent study called Project Aristotle by Google?

A. Dysfunctional teams typically failed because of member skill level. B. Teams that succeeded were made-up of people with higher than average IQs. C. Dysfunctional teams failed because of wrong norms. D. Having intelligent team members results in positive norms.

A restaurant offering a discount on a meal that that was not prepared properly is an example of _____.

What will be an ideal response?

Which of the following is false concerning special basis adjustments under Section 754?

A. Special basis adjustments can occur when a new investor purchases a partnership interest. B. Special basis adjustments are intended to eliminate discrepancies between inside and outside bases. C. Special basis adjustments are an annual election made by the partnership. D. Special basis adjustments can occur when a partner recognizes a gain or loss from a distribution.

Bejukistan Laboratories Inc. has a national competitive advantage in the pharmaceutical industry. This means that the country

A. has low levels of competition, providing other multinational companies with an opportunity to take over the pharmaceutical industry. B. is a world leader in the pharmaceutical industry. C. has nationalized the pharmaceutical industry. D. is a potential foreign market for multinational pharmaceutical companies to sell their products.