Briefly describe how imports and taxes affect the size of the expenditure multiplier

What will be an ideal response?

Both imports and taxes make the expenditure multiplier smaller. When the marginal propensity to import is larger, more of the induced consumption expenditure goes towards foreign goods, which have no effect on domestic production or income. When the tax rate is higher, more of the induced change in income goes towards taxes, leaving less available for spending.

You might also like to view...

Starting from long-run equilibrium, a decrease in autonomous investment results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; higher C. higher; potential D. lower; higher

When airplanes take off and land at Logan airport, residents of East Boston complain about the noise. The same planes make the same noise during the trip to Boston from Paris, but there are no ____ for most of the trip because ____.

A. free riders; passengers must pay to board the plane B. third parties; there are no externalities C. externalities; there are no third parties D. complaints; airplanes are insulated

Every transaction concerning the exportation of goods from the United States constitutes a

A) supply of foreign currency with no effect on the market for the dollar. B) demand for dollars with no effect on markets for foreign currencies. C) supply of foreign currencies and a demand for dollars. D) demand for foreign currencies and a supply of dollars.

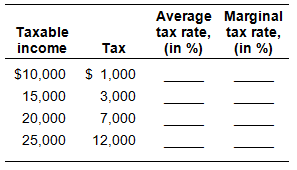

Given the following information on the tax paid for different levels of taxable income, fill in the average and the marginal tax rates for each income level. Also explain how to calculate the average tax rate and the marginal tax rate. Is this tax

progressive?