Chase Company rents space to a tenant for $2600 per month. The tenant currently owes rent for November and December. The tenant has agreed to pay the November, December, and January rents in full on January 15 and has agreed not to fall behind again. The adjusting entry needed on December 31 is:

A. Debit Rent Receivable, $7800; credit Rent Earned, $7800.

B. Debit Rent Receivable, $5200; credit Rent Earned, $5200.

C. Debit Rent Receivable, $2600; credit Rent Earned, $2600.

D. Debit Unearned Rent, $2600; credit Rent Earned, $2600.

E. Debit Unearned Rent, $5200; credit Rent Earned, $5200.

Answer: B

You might also like to view...

Another term for expense is:

a. unexpired cost. b. expired cost. c. net loss. d. none of these are correct.

The golden rule, "Do unto others as you would have them do unto you," is most directly

reflected in which moral theory? A) Rawls's distributive justice theory B) Ethical relativism C) Ethical fundamentalism D) Kantian ethics E) Utilitarianism

Which of the following countries does not base its legal system on code law?

A) Great Britain B) Italy C) France D) Spain

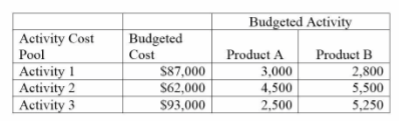

Annual production and sales level of Product A is 34,300 units, and the annual production and sales level of Product B is 69,550 units. What is the approximate overhead cost per unit of Product A under activity-based costing?

A company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

A) $3.00

B) $2.00

C) $10.28

D) $15.00

E) $2.33