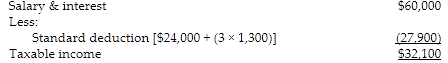

Required: Compute their taxable income.

Sean and Martha are both over age 65 and Martha is considered blind by tax law standards. Their total income in 2018 from part-time jobs and interest income from a bank savings account is $80,000. Their itemized deductions are $25,000.

The standard deduction is increased because of age for both and blindness for Martha.

You might also like to view...

In determining lifetime value for individual customers, customer acquisition costs are determined by:

A) dividing advertising costs by the number of customer transactions B) dividing the total marketing and advertising costs by the number of new customers C) dividing the total marketing and advertising costs by the number of total customers D) dividing the advertising costs associated with acquiring new customers by the number of new customers

In a backflush accounting system, a single account is used for the following:

a. Work in process and finished goods inventories. b. Finished goods inventories and cost of goods sold. c. Factory overhead and raw materials. d. Raw materials and work in process inventories.

How do marketing organizations benefit from cultural diversity?

What will be an ideal response?

It is best to avoid smiling during a phone interview

Indicate whether the statement is true or false