Your company is planning to issue $1,000 bonds with a stated interest rate of 7% and a maturity date of July 15, 2022. If interest rates rise in the economy so that similar financial investments pay 9%, your company will:

A. have to reprint the bond certificates to change the stated interest rate to 9%.

B. have to accept a lower issue price to attract buyers.

C. not be able to issue the bonds because no one will buy them.

D. receive a higher issue price to compensate buyers for the lower stated interest rate.

Answer: B

You might also like to view...

What is the difficulty in using horizontal, vertical, or ratio analysis?

a. The complicated calculations required to arrive at change statements. b. Identifying the changes and speed of changes in the ratios, when the change is unexpected or unexplained. c. Knowing when a change in account balance or relationship is significant enough to signal possible fraud. d. Assessing the magnitude or significance of changes in account balances looking only at raw financial statement numbers.

Discuss the adage "hire for attitude, train for skill." What are its implications for the attraction, training, and retention of top talent?

What will be an ideal response?

No one leadership theory is a fit for all situations.

a. True b. False

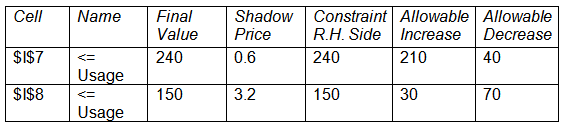

Consider the sensitivity analysis report that follows. The shadow price of $0.6 is valid as long as the right-hand constraint of 240 is within the range of ______.

a. 200 to 450

b. 150 to 240

c. 200 to 300

d. 40 to 210