According to the Ricardian equivalence theorem, a tax cut that increases the government budget deficit will have

A) a positive effect on aggregate demand because people look at changes in taxes or government spending in the present.

B) no effect on aggregate demand because people only look at changes in taxes or government spending in the present.

C) no effect on aggregate demand because people realize that there will be a future tax liability so that there is no increase in consumption expenditures.

D) an effect on aggregate demand. The magnitude the effect will have depends upon whether the increase is caused by a reduction in taxes or an increase in government spending.

C

You might also like to view...

A boycott of products sold by companies that are dealing with a company whose workers are on strike is a

A) jurisdictional dispute. B) sympathy strike. C) right-to-boycott law. D) secondary boycott.

The Fed increases the money supply by buying securities for $300 million. The impact of this increase, in the long-run, would be to

A. raise the average price level and increase the level of real GDP. B. raise the average price level, but real GDP (output) would stay the same. C. raise the real supply of loanable funds, lower the interest rate, and increase the demand for output. D. raise the real supply and demand for loanable funds with an increase in the interest rate.

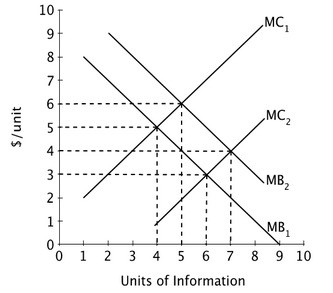

Refer to the figure below. The growth of access to the Internet will cause the marginal:

A. benefit curve to shift from MB2 to MB1. B. cost curve to shift from MC2 to MC1. C. benefit curve to shift from MB1 to MB2. D. cost curve to shift from MC1 to MC2.

Which of the following is an example of an investment in human capital?

A. A chemical firm supports research to develop new chemicals. B. A firm pays for workers to take college classes. C. A firm replaces manually controlled production with a computer controlled procedure. D. A firm purchases new equipment for a manufacturing process.