If an individual pays an additional $0.30 in taxes as a result of a $1.00 increase in income, then that individual must have a(n) __________ tax rate of 30 percent

A) average

B) fixed

C) total

D) marginal

D

You might also like to view...

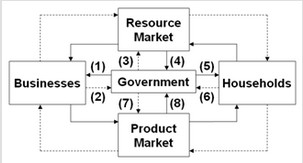

Use the following diagram to answer the next question. In the diagram, solid arrows reflect real flows and broken arrows are monetary flows. Flow (3) might represent

In the diagram, solid arrows reflect real flows and broken arrows are monetary flows. Flow (3) might represent

A. government salaries paid to school teachers. B. a state university's purchase of computers. C. property tax payments. D. social security payments to retirees.

A perfectly competitive firm will continue to operate in the short run when the market price is below its average total cost if the

A) marginal revenue is greater than marginal cost. B) price is at least equal to the minimum average variable cost. C) total fixed costs are less than total revenue. D) marginal cost is minimized. E) price is also less than the minimum average variable cost.

Your employer has asked you to start working overtime and has offered to pay $18 per hour for every hour you work beyond forty hours a week. The wage rate for each of the first forty hours will continue to be the usual $15 per hour

In terms of dollars, what is the marginal benefit of working each hour of overtime? A) zero B) $3.00 C) $15.00 D) $18.00

The Great Depression really began in the second half of the year ________.

Fill in the blank(s) with the appropriate word(s).