Which of the following is true? The federal government's budget

a. was always in surplus until the 1980s

b. is in deficit now but has been in surplus in most of the past 40 years

c. has been virtually perfectly balanced for the past 5 years

d. deficit has averaged around zero for the last several decades

e. switched from deficits to surpluses in the late 1990s

E

You might also like to view...

Under the gold standard

A) a perpetual surplus is possible. B) a perpetual deficit is possible. C) a perpetual surplus is impossible, but a perpetual deficit is possible. D) a perpetual deficit is impossible, but a perpetual surplus is possible. E) a perpetual surplus is impossible.

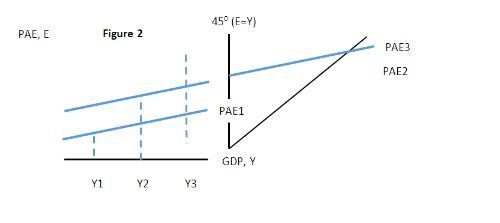

Using Figure 2 below, suppose that the economy started at PAE2. A potential change that could cause the economy to go from PAE2 to PAE1 might be:

A. wealth level increases.

B. interest rates increase.

C. taxes decrease.

D. domestic income decreases.

If the demand effect dominates during a currency depreciation, then

a. real GDP should fall. b. real GDP should increase. c. the price level should fall. d. net exports should decrease.

The United States has imposed taxes on some imported goods that have been sold here by foreign countries at below their cost of production. These taxes

a. benefit the United States as a whole, because they generate revenue for the government. In addition, because the goods are priced below cost, the taxes do not harm domestic consumers. b. benefit the United States as a whole, because they generate revenue for the government and increase producer surplus. c. harm the United States as a whole, because they reduce consumer surplus by an amount that exceeds the gain in producer surplus and government revenue. d. harm the United States as a whole, because they reduce producer surplus by an amount that exceeds the gain in consumer surplus and government revenue.