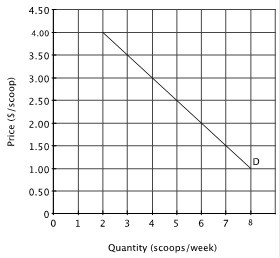

The figure below shows a single consumer's demand for ice cream at the student union.  During the summer, there are 300 students on campus. Each student's weekly demand for ice cream is shown above. When the price of ice cream is $2.00 per scoop, those 300 students purchase a total of ________ scoops per week from the student union.

During the summer, there are 300 students on campus. Each student's weekly demand for ice cream is shown above. When the price of ice cream is $2.00 per scoop, those 300 students purchase a total of ________ scoops per week from the student union.

A. 3,000

B. 1,200

C. 1,800

D. 1,500

Answer: C

You might also like to view...

The country of Kemper is on its aggregate production function at point W in the above figure. The government of Kemper passes a law that makes 4 years of college mandatory for all citizens. After all citizens have their education, the economy will

A) move to point such as Y. B) remain at point W. C) move to point such as X. D) move to point such as Z.

Prime Pharmaceuticals has developed a new asthma medicine, for it has a patent. An inhaler can be produced at a constant marginal cost of $2/inhaler

The demand curve, marginal revenue curve, and marginal cost curve for this new asthma inhaler are in the figure above. With its patent giving it a monopoly for its new inhaler, if it is a single-price monopoly, Prime Pharmaceuticals will produce ________ inhalers and set a price of ________ for each inhaler. A) 16 million; $2 B) 10 million; $5 C) 8 million; $6 D) 8 million; $2

According to quantitative estimates of the burden of the Navigation Acts on the colonies, what can be said about the (net) effect of the Acts?

a. The Navigation Acts placed a serious economic burden on the colonies, with estimates of this burden equaling roughly 40 percent of 1770s GNP. b. The Navigation Acts were the critical reason why colonists revolted against the British. c. After accounting for the protection provided by the British, there was very little economic burden to colonists from the Navigation Acts. d. Existing data do not allow for credible estimates of the economic burden of the Navigation Acts on the colonies.

Suppose a tax rate of 10 percent applies to all income up to $20,000 a year, income above $20,000 up to $50,000 a year is taxed at a rate of 15%, and income above $50,000 a year is taxed at 20%. Calculate the absolute amount of tax paid by a person whose annual income is $30,000

a. $2,000 b. $2,500 c. $4,500 d. $4,000 e. $3,500