Suppose a tax rate of 10 percent applies to all income up to $20,000 a year, income above $20,000 up to $50,000 a year is taxed at a rate of 15%, and income above $50,000 a year is taxed at 20%. Calculate the absolute amount of tax paid by a person whose annual income is $30,000

a. $2,000

b. $2,500

c. $4,500

d. $4,000

e. $3,500

e

You might also like to view...

According to the law of diminishing utility, _____

a. the same tax rate should be applied to every dollar b. the rich people should have a lower tax rate as compared to poor people c. the rich people should have a higher tax rate as compared to poor people d. the total burden on the society from a tax will be less if proportional taxation is used e. the poorer people should not be taxed at all

If cherries cost twice as much as dates, and the last cherry consumed provides twice as much utility as the last date consumed, the consumer is maximizing utility

a. True b. False Indicate whether the statement is true or false

Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the real risk-free interest rate and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The real risk-free interest rate falls and reserve-related (central bank) transactions become more negative (or less positive). b. The real risk-free interest rate rises and reserve-related (central bank) transactions become more negative (or less positive). c. The real risk-free interest rate falls and reserve-related (central bank) transactions remain the same. d. The real risk-free interest rate rises and reserve-related (central bank) transactions remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

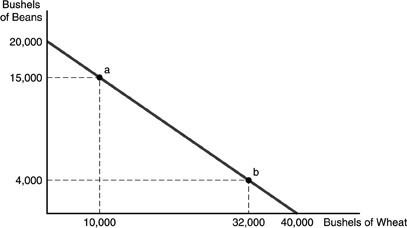

Refer to the above figure. If the farmer is growing 8,000 bushels of beans and 8,000 bushels of wheat, then we know that

Refer to the above figure. If the farmer is growing 8,000 bushels of beans and 8,000 bushels of wheat, then we know that

A. the farmer cannot be using the amount of land that was used to construct the curve. B. the farmer is not using resources efficiently. C. the farmer is using more land for wheat than for beans. D. the farmer should increase the amount of wheat grown and reduce the amount of beans.