Activities A, B, and C are all passive activities. Based on this information, Joy has

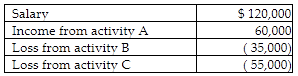

Joy reports the following income and loss:

A) adjusted gross income of $90,000.

B) salary of $120,000 and deductible net losses of $30,000.

C) salary of $120,000 and net passive losses of $30,000 that will be carried over.

D) salary of $120,000, passive income of $60,000, and passive loss carryovers of $90,000.

C) salary of $120,000 and net passive losses of $30,000 that will be carried over.

The losses from passive activities B and C may offset and eliminate the income from passive activity A resulting in a net passive loss of $30,000 ($60,000 income less $90,000 loss). The passive loss of $30,000 may not offset the salary and must be carried over to the next tax year.

You might also like to view...

Jim was a crook. He embezzled $450,000 from his employer. When his employer found out about his misdeeds, before even conducting a thorough investigation, he went and gave all the details to a local newspaper agency. The next day Jim read his own story, with his own name, in the newspaper. Which of the following is correct?

a. The company did the right thing by publishing Jim's identity in the newspaper because it punished him for stealing as well as served a warning to his neighbors who might also be at the risk of being defrauded. b. The company should not have put Jim's name and story in the paper because when other employees will come to know about it, they might leave the organization. c. Jim may have been misrepresented in the story by the newspaper agency and the company might face legal consequences. d. Publishing the story in the newspaper was a wrong thing to do because Jim's family will be embarrassed.

For tax purposes, small businesses may expense the first $250,000 of equipment expenditures, rather than having to allocate their costs over a number of years

Indicate whether the statement is true or false

Which of the following entries records the receipt of cash for two months' rent? The cash was received in advance of providing the service

A) Prepaid Rent, debit; Rent Revenue, credit. B) Cash, debit; Unearned Rent, credit. C) Cash, debit; Prepaid Rent, credit. D) Cash, debit; Rent Expense credit.

Grant is a delivery person for Watkins Furniture. One day, after delivering a chair to Nadine's house, he stopped at a fast food restaurant to get a sandwich at the drive-through window. As he was leaving the parking lot, he accidentally hit the rear of

Blanche's car. Discuss the possible liability of Watkins for Grant's accident. Would there be any difference in the potential liability of Watkins if Grant had the accident after driving 30 miles away to visit a friend?