From the following details of a merchandiser, calculate the Cost of Goods Sold. (Assume the merchandiser uses the periodic inventory system

)

Net Sales $198,000

Purchases 92,000

Purchase Returns and Allowances 1,800

Purchase Discounts 1,400

Freight In 1,350

Beginning Merchandise Inventory 62,000

Ending Merchandise Inventory 36,000

A) $116,150

B) $62,800

C) $114,800

D) $54,150

A .Calculation of Cost of Goods Sold:

Beginning Merchandise Inventory $62,000

Purchases $92,000

Less: Purchase Returns and Allowances 1,800

Less: Purchase Discounts 1,400

Net Purchases $88,800

Plus: Freight In 1,350

Net Cost of Purchases 90,150

Cost of Goods Available for Sale $152,150

Less: Ending Inventory 36,000

Cost of Goods Sold $116,150

You might also like to view...

While designing a customer-driven marketing strategy, marketers are likely to divide the market into smaller segments

Indicate whether the statement is true or false

Which of the following concepts is often given as justification not to value noncurrent operating assets at their current values?

a. The revenue principle b. Verifiability c. Relevance d. Predictive value

Commas keep English sentences ____________

a. short b. in order c. connected d. readable

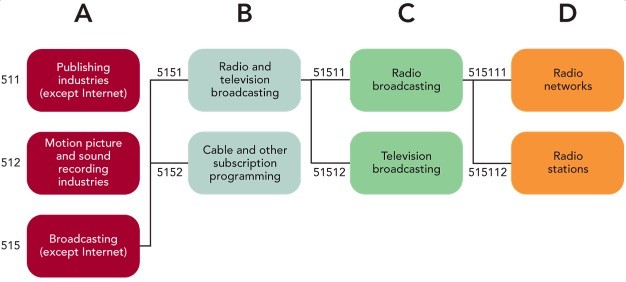

Figure 5-1In the breakdown for the NAICS code based on Figure 5-1 above, D represents the

Figure 5-1In the breakdown for the NAICS code based on Figure 5-1 above, D represents the

A. three-digit industry subsector code. B. four-digit industry group code. C. five-digit industry code. D. six-digit U.S. national industry code. E. two-digit industry sector code.