Consider the Taylor rule for the target of the federal funds rate. Suppose the equilibrium real federal funds rate is 2 percent, the target rate of inflation is 3 percent, the current inflation rate is 3 percent, real GDP equals potential real GDP, and

the weights are 1/2 for the inflation gap and the output gap. Using the Taylor rule, what does the target for the federal funds rate equal? Next, if the Federal Reserve lowered the target for the inflation rate to 1 percent, how much would the target for the federal funds rate change?

What will be an ideal response?

The federal funds target rate would equal 5 percent. With no inflation gap or output gap, the federal funds target rate equals the current inflation rate plus the equilibrium real federal funds rate. A decrease in the inflation target from 3 percent to 1 percent with a weight on the inflation gap of 1/2 would raise the federal funds target rate by 1 percentage point, from 5 percent to 6 percent.

You might also like to view...

In considering "returns to scale" we assume that production processes are homothetic.

Answer the following statement true (T) or false (F)

A perfectly inelastic demand curve is

a. a vertical straight line b. a horizontal straight line c. a downward-sloping straight line d. an upward-sloping straight line e. not a straight line

The real rate of interest measures the ________ of capital investment.

A. opportunity cost B. value of the marginal product C. relative price D. marginal benefit

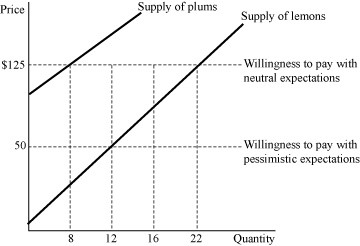

Figure 9.1 represents the market for used bikes. Suppose buyers are willing to pay $200 for a plum (high-quality) used bike and $50 for a lemon (low-quality) used bike. If buyers believe that 50% of used bikes are lemons (low quality), how many plums (high quality) will be supplied by sellers?

Figure 9.1 represents the market for used bikes. Suppose buyers are willing to pay $200 for a plum (high-quality) used bike and $50 for a lemon (low-quality) used bike. If buyers believe that 50% of used bikes are lemons (low quality), how many plums (high quality) will be supplied by sellers?

A. 8 B. 12 C. 16 D. 22