The peak oil hypothesis says that the annual world production of oil

a. will not peak for several hundred years.

b. peaked in the past two decades and is now rapidly declining.

c. will peak in the coming decades and then decline.

d. is now peaking and a major decline is imminent.

c. will peak in the coming decades and then decline.

You might also like to view...

The Jerry-Berry Ice Cream Shoppe's total cost schedule is in the above table. Based on the table, which of the following is correct?

A) The total fixed cost is $1. B) The average fixed cost of 1 gallon is $1.00. C) The average variable cost of 2 gallons of ice cream is $1.00 per gallon. D) Only answers A and B are correct. E) Answers A, B, and C are correct.

If banks were required to keep 100% of deposits in reserves, they could

A) make more loans. B) make no loans. C) create more deposits. D) only use required reserves for loans.

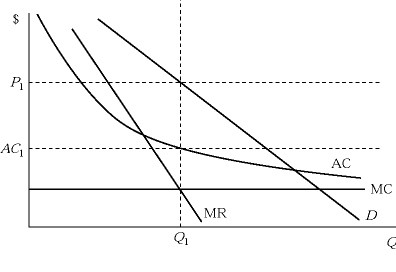

Figure 11.1If Figure 11.1 depicts the current situation for a monopolistically competitive firm, then in the long run we expect:

Figure 11.1If Figure 11.1 depicts the current situation for a monopolistically competitive firm, then in the long run we expect:

A. the firm to charge a price higher than P1. B. the firm to produce and sell more than Q1. C. the average costs of production to decrease below AC1. D. the firm to charge a price lower than P1.

Many universities have either a top football program OR a top basketball program. Very few have both. These results suggest the presence of

A) economies of scope. B) diseconomies of scope. C) returns to scale. D) the law of diminishing marginal returns.