The financial staff at Safe-Life Systems, Inc., an alarm systems manufacturer, has estimated the following sales and other expense figures for the second half of 2017:

1. Actual sales in June 2017 were $105,000. The firm sells 60% on cash, it collects 39% of the remainder one month after the sale, and 1% are written off as bad debts. Purchases are estimated to represent 55% of the next month’s sales. The firm pays 40% of its purchases in cash and the remainder during the following month. Commissions to sales associates represent 15% of collectable sales, but the firm has decided to include a bonus of 5% more if the sales of the current month are higher than the previous one. Each of the two partners is paid 20% of the average total sales of the previous and current month, plus a 5% bonus if the sales of the current month are higher than the previous one. Monthly wages, rent, and lease expenses are $5,000, $3,000, and $1,500, respectively. The firm has an ending cash balance of $25,000 in June 2017.

a) Create a cash budget for July to December 2017, and determine the firm’s ending cash balance in each month if the firm has a required minimum monthly cash balance of $25,000.

b) The partners are considering a line of credit from a commercial bank. Determine the amount that would be necessary to meet the total borrowing needs for July to December 2017. Round the result to the next highest $10,000.

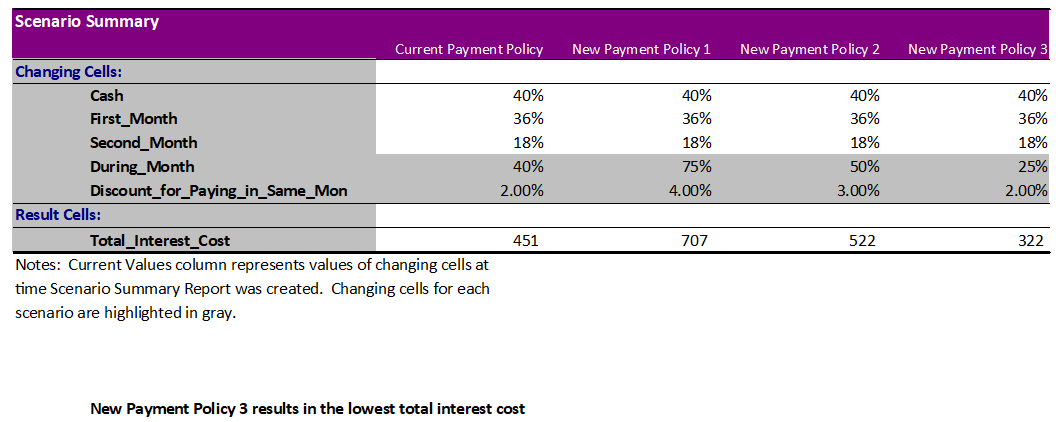

c) Consider three scenarios. In the first scenario, monthly revenues are 5% better than expected, but cash sales are 40% of forecasted revenue, while credit sales are 58% and 2% are written off as bad debts. In the second scenario, sales are exactly as expected and the original collection policy is implemented. In the last scenario, sales are 5% worse than expected, but cash sales are 70% of forecasted revenue, while credit sales account for the remaining 30% with no bad debts. Use the Scenario Manager to determine the amount that the firm would need to borrow to maintain its minimum cash balance in all three scenarios.

You might also like to view...

Helena was surprised to learn that the car and home insurance agency she was just hired by does not have a CRM program. Why should the agency have a CRM program, and what CRM efforts should Helena recommend?

What will be an ideal response?

1. Identify three tenets of expectancy theory? (243-244) What does expectancy theory assume?

What will be an ideal response?

In the context of business opportunities in the government market, the General Services Administration handles

A. administrative tasks for small service customers. B. complaints filed against suppliers by organizational buyers. C. vendor analysis for the core industries. D. information on the prices of luxury goods in the U.S. market. E. vendor contracts for off-the-shelf goods and services.

The CSR position is a good occupation that affords the opportunity to learn solid business skills and often leads to administrative, sales, and other related positions within organizations.

Answer the following statement true (T) or false (F)