The area set aside for merchandise displays, interactions between sales personnel and customers, and demonstrations is _____ space

a. customer

b. merchandise

c. personnel

d. selling

d

You might also like to view...

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

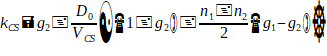

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

With regard to health and safety at a workplace, ________ can be determined by comparing the probabilities of harm involved in various activities.

A. absolute impediments B. relative risks C. variable obstacles D. comparative barriers

____ sentences contain at least two independent clauses and one dependent clause

A) Simple B) Compound C) Complex D) Compound-complex

Assume that you hold a well-diversified portfolio that has an expected return of 11.0% and a beta of 1.20. You are in the process of buying 1,000 shares of Alpha Corp at $10 a share and adding it to your portfolio. Alpha has an expected return of 21.5% and a beta of 1.70. The total value of your current portfolio is $90,000. What will the expected return and beta on the portfolio be after the purchase of the Alpha stock? Do not round your intermediate calculations.

A. 13.98%; 1.28 B. 12.29%; 1.48 C. 12.41%; 1.56 D. 12.05%; 1.25 E. 9.40%; 1.34