A consumer's weekly income is $300 and the consumer buys 5 bars of chocolate per week. When income increases to $330, the consumer buys 6 bars per week. The income elasticity of demand for chocolate by this consumer is about:

A. 0

B. 0.5

C. 1

D. 2

D. 2

You might also like to view...

Assume that the central bank purchases government securities in the open market. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the GDP Price Index and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The GDP Price Index falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). b. The GDP Price Index and net nonreserve-related international borrowing/lending remain the same. c. The GDP Price Index falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). d. The GDP Price Index rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). e. The GDP Price Index rises, and net nonreserve-related international borrowing/lending becomes more positive (or less negative).

Which of the following helped reduce sulfur dioxide emissions, a leading cause of acid rain? (i) corrective taxes (ii) tradable pollution permits (iii) amendments to the Clean Air Act

a. (i) only b. both (i) and (ii) c. (iii) only d. both (ii) and (iii)

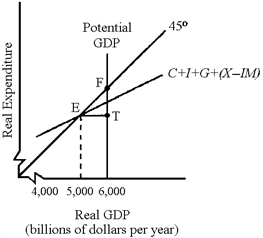

Figure 11-1

In Figure 11-1, to reach the level of potential GDP, the administration of President Obama would most likely advocate

a.

increasing Social Security payments.

b.

decreasing defense spending.

c.

decreasing personal income taxes.

d.

All of the above are correct.

If product prices were stated in terms of gallons of milk, then milk would be functioning primarily as:

A. legal tender. B. a unit of account. C. fiat money. D. a store of value.