Suppose that a farmer grows wheat and sells it to a baker for €1, the baker makes bread and sells it to a store for €2, and the store sells it to the customer for €3. This series of transactions increases GDP by:

A. €1.

B. €2.

C. €3.

D. €6.

Ans: C. €3.

You might also like to view...

Suppose an individual has to make a decision at time t without having all the information relevant for making the decision. At time (t+1), the relevant information is revealed. We will say that the individual made a mistake if his decision in time t would have been different had he known what he knows at time (t+1). True or False: Without behavioral economics, we would not be able to explain mistakes.

Answer the following statement true (T) or false (F)

In the above figure, real GDP at full employment is

A) $16 trillion. B) $16.5 trillion. C) more than $16 and less than $16.5 trillion. D) None of the above answers is correct.

If the world price of a good is lower than its domestic equilibrium price, the country will:

a. import a quantity of the good equal to the difference between the quantity demanded domestically and the quantity supplied domestically. b. export a quantity of the good equal to the difference between the quantity demanded domestically and the quantity supplied domestically. c. import a quantity of the good equal to the difference between the quantity demanded domestically and the quantity supplied by foreign producers. d. export a quantity of the good equal to the difference between the quantity demanded by foreign consumers and the quantity supplied domestically. e. import a quantity of the good equal to the difference between the quantity demanded by foreign consumers and the quantity supplied by foreign producers.

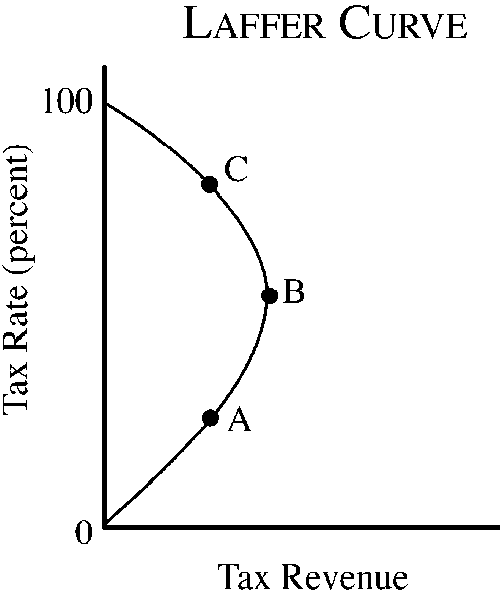

Figure 4-11

Refer to . On the Laffer curve shown, tax revenue could be increased by

a.

decreasing the marginal tax rates if we were currently at point A.

b.

decreasing the marginal tax rates if we were currently at point C.

c.

increasing the marginal tax rates if we were currently at point B.

d.

increasing the marginal tax rates if we were currently at point C.