Refer to Scenario 7.1 below to answer the question(s) that follow. SCENARIO 7.1: You are the owner and only employee of a company that writes computer software that is used by gamblers to collect sports data. Last year you earned a total revenue of $90,000. Your costs for equipment, rent, and supplies were $60,000. To start this business you invested an amount of your own capital that could pay you a return of $40,000 a year. Refer to Scenario 7.1. A yearly normal return for your computer software firm would be

A. $20,000.

B. $40,000.

C. $60,000.

D. $100,000.

Answer: B

You might also like to view...

A firm's accounting profit is also its

A) economic profit. B) net income. C) statement of liabilities. D) income statement.

If the real interest rate and the nominal interest rate are both negative and equal to each other, then the

A. inflation premium is zero. B. inflation premium is also negative. C. inflation premium is positive. D. economy must be in a recession.

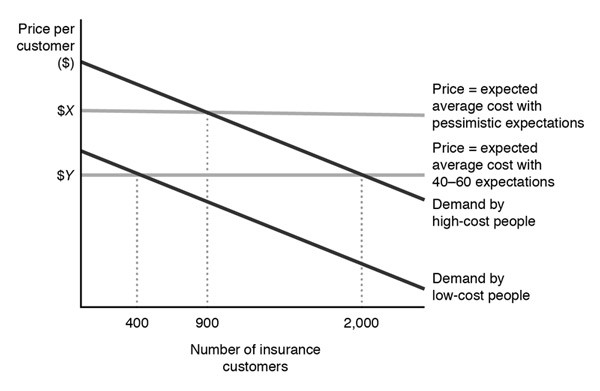

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. Initially the insurance companies estimate that 40% of its customers are high-cost type. Compared to the outcome with pessimistic expectations, how many more customers buy health insurance?

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. Initially the insurance companies estimate that 40% of its customers are high-cost type. Compared to the outcome with pessimistic expectations, how many more customers buy health insurance?

A. 500 B. 1,300 C. 1,500 D. 1,600

Trade can stifle the development of industries than might be more efficient than existing ones

Indicate whether the statement is true or false