Assume the spot rate for the Japanese yen currently is ¥106.83 per dollar while the one-year forward rate is ¥107.20. Also assume a risk-free asset in Japan is currently earning 4.6 percent. If interest rate parity holds, approximately what rate can you earn on a one-year risk-free U.S. security?

A) 4.24 percent

B) 5.08 percent

C) 4.62 percent

D) 4.78 percent

E) 4.96 percent

A) 4.24 percent

Explanation: (¥107.20/¥106.83) = [1.046/(1 + RUS)]

RUS = .0424, or 4.24%

You might also like to view...

Suppose a bank's excess reserves are equal to $100 million. The bank is required to hold $50 million as reserves. The bank currently holds _____ as reserves.

A. $50 million B. $100 million C. $150 million D. $200 million

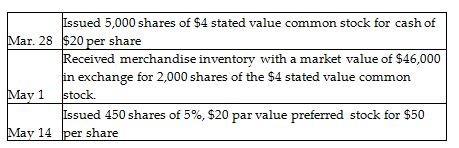

Budget Office Supply Corporation completed the following stock issuance transactions:

Prepare the journal entries to record these transactions. Explanations are not required.

Not all companies that use income segmentation target the affluent

Indicate whether the statement is true or false

If a company borrows money from a bank, the interest paid should be reported on the statement of cash flows as a(n):

a. operating activity. b. investing activity. c. financing activity. d. noncash investing and financing activity. e. either an investing activity or a financing activity.