Which of the following statements about taxation is TRUE?

A) Increasing taxes will always increase tax revenues.

B) Static tax analysis recognizes that an increase in taxation could lead to a decrease in tax revenues.

C) Dynamic tax analysis assumes that an increase in taxation will leave the tax base unchanged.

D) There is a tax rate at which tax revenues are maximized.

Answer: D

You might also like to view...

Suppose the economy is initially in equilibrium where real GDP equals potential GDP and the inflation rate is at the target rate

Other things equal, a housing boom will cause aggregate expenditures to increase, which will result in a new, short-run equilibrium. To return GDP to its potential level, the inflation rate will adjust. With adaptive expectations, this will result in A) an increase in aggregate demand and an increase in the inflation rate. B) a decrease in aggregate supply and an increase in the inflation rate. C) a decrease in aggregate demand and a decrease in the inflation rate. D) an increase in aggregate supply and a decrease in the inflation rate.

The environmentally friendly firm will operate at a lower marginal and average cost than those firms that shift some costs onto society in the form of external costs

Indicate whether the statement is true or false

In a monopoly labor market, the optimal union wage can be read off the marginal revenue product curve.

Answer the following statement true (T) or false (F)

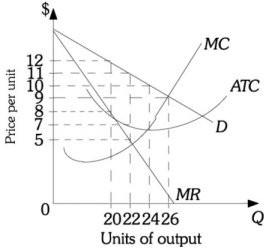

Refer to the information provided in Figure 13.4 below to answer the question(s) that follow.  Figure 13.4Refer to Figure 13.4. The profit-maximizing price for this firm is

Figure 13.4Refer to Figure 13.4. The profit-maximizing price for this firm is

A. $5. B. $7. C. $9. D. $11.