On November 3rd of this year, Kerry acquired and placed into service 7-year business equipment costing $80,000. In addition, on May 5th of this year, Kerry had also placed in business use 5-year recovery property costing $15,000. Kerry did not apply Sec. 179 immediate expensing or bonus depreciation. No other assets were purchased during the year. The depreciation for this year is

A) $3,606.

B) $6,606.

C) $13,576.

D) $14,432.

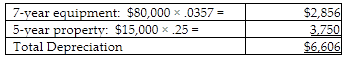

B) $6,606.

Equipment placed in service in last 3 months of year: $80,000/$95,000 = 84% of all equipment; therefore, the mid-quarter convention must be used on all personal property placed in service during the year.

You might also like to view...

A truck is purchased for $35,000 . It has a five-year life and a $5,000 residual value. Under the straight-line method, what is the asset's carrying value after three years?

a. $23,000 b. $17,000 c. $12,000 d. $18,000

The elegance criterion for voice systems requires that they should be simple to understand, apply to a broad range of issues, and allow for a definitive response.

Answer the following statement true (T) or false (F)

When we need to be particularly sure about the quality of a product, we should ______.

a. do a process capability analysis at the start of the production run to ensure the process is working well and repeat the process capability analysis frequently b. do a Pareto analysis frequently to ensure that the mean is not shifting c. do a physical inspect of each unit produced to ensure compliance with customer requirements d. do a specification conformance test

The unearned premium reserve of an insurer is

A) an asset representing the investments made with premium income. B) a liability representing the unearned portion of gross premiums on outstanding policies. C) a liability representing claims that have been filed, but not yet paid. D) the portion of the insurer's net worth belonging to policyowners.