Dorothy likes to invest in gold as part of her overall financial investment portfolio, as her gut tells her it will increase dramatically in value. Her favorite and generally only source of investment advice is Wizard's Gold Hour on the OZ cable

channel. As a result of this advice, Dorothy's portfolio mix is suboptimal, as it is too heavily weighted in gold. Behavioral economists would say that Dorothy suffers from:

A. framing effects.

B. confirmation bias.

C. self-serving bias.

D. planning fallacy.

Answer: B

You might also like to view...

Consider a market in which there is an external benefit. The inefficient market equilibrium is such that

A) too little output is produced. B) too much output is produced. C) price is too high. D) marginal social cost is greater than marginal social benefit.

Competition between oligopolists drives:

A. price and profits down to below the monopoly level. B. price and profits down to the perfect competition level. C. some firms out until the market becomes a monopoly. D. collusion to happen frequently.

If there is an excess demand for money in the economy,

a. there is also an excess supply of money. b. there is also an excess demand for bonds. c. there is also an excess supply of bonds. d. the interest rate will fall. e. there is also an excess supply of housing.

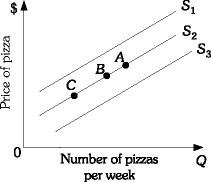

Refer to the information provided in Figure 3.10 below to answer the following question(s). Figure 3.10Refer to Figure 3.10. A movement from Point C to Point B on supply curve S2 would be caused by a(n)

Figure 3.10Refer to Figure 3.10. A movement from Point C to Point B on supply curve S2 would be caused by a(n)

A. increase in the demand for pizza. B. increase in the price of hamburgers, assuming hamburgers are a substitute for pizza. C. decrease in the price of pizza dough. D. decrease in the price of pizza.