The spread (difference) between the yield on conventional bonds and the yield on indexed bonds with the same maturities is an indication of the expected inflation rate

Indicate whether the statement is true or false

True

You might also like to view...

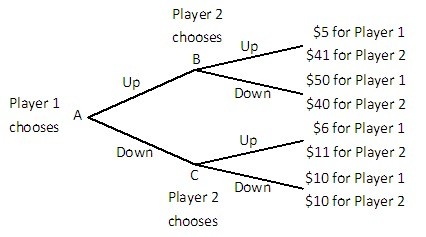

Player 1 and Player 2 are playing a game in which Player 1 has the first move at A in the decision tree shown below. Once Player 1 has chosen either Up or Down, Player 2, who can see what Player 1 has chosen, must choose Up or Down at B or C. Both players know the payoffs at the end of each branch.  If Player 2 could make a credible commitment to choose either Up or Down when his or her turn came, then what would Player 2 do?

If Player 2 could make a credible commitment to choose either Up or Down when his or her turn came, then what would Player 2 do?

A. Player 2 would commit to choosing Down. B. Player 2 would commit to choosing Up. C. Player 2 would not commit to choosing either strategy. D. Player 2 would commit to mimicking Player 1's strategy.

If real GDP is greater than potential GDP, then to restore equilibrium, ________ and the price level ________

A) the aggregate supply curve shifts rightward; falls B) the aggregate demand curve shifts leftward; rises C) the aggregate supply curve shifts leftward; rises D) the aggregate demand curve shifts rightward; falls E) potential GDP increases; falls

In September 1992, Great Britain changed its exchange rate system. How?

A) It abandoned the gold standard in favor of pegging to the U.S. dollar. B) It joined in with the new euro. C) It switched from an exchange rate peg to floating. D) It abandoned the sterling backing for the British pound.

Which economist argued that free markets unleashed the "animal spirits" of entrepreneurs, propelling innovation, technology, and growth?

A. Irving Fisher. B. Lord Kelvin. C. John Maynard Keynes. D. Kenneth Olsen.