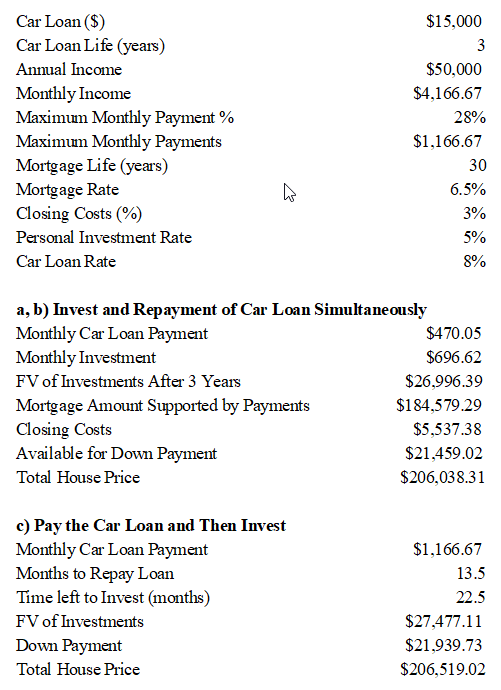

You want to buy a house, but you still need to pay your car loan of $15,000 over the next 3 years. Your annual income is $50,000 and the bank estimates that your monthly mortgage payments should not represent more than 28% of your monthly income. You have decided to use that percentage of your current income to repay your car loan and to save for the down payment on the house. In this way you will adjust your current monthly expenses to be ready to make the same monthly payments for 30 years. You estimate that you can get a fixed interest rate of 6.5% on a 15-year mortgage. Closing costs are estimated to be 3% of the loan value and you can invest at an average rate of 5%. If the interest on the auto loan is 8%, determine the following:

a) What is the monthly payment on the car loan? How much can you invest each month?

b) If you decide to repay your car loan and invest the rest for the down payment at the same time, how much money will the bank loan you in five years? How much can you offer for the house?

c) Is there any change in your answers for part (a) if you decide to pay off the car before you begin to investment for the down payment?

You might also like to view...

Where a party has been induced by fraud to enter a contract, the Restatement of Torts permits the injured party to recover out-of-pocket damages but expressly excludes recovery of benefit-of-the-bargain damages

a. True b. False Indicate whether the statement is true or false

Two non-competing global firms meet quarterly to discuss multiple perspectives on world trends. This is an example of how to improve

A. internal scanning. B. financial returns. C. perceptual acuity. D. stakeholder management.

Relying exclusively on merit pay or individual incentives may result in high levels of work motivation but unacceptable levels of individualistic and competitive behavior.

Answer the following statement true (T) or false (F)

What are switching costs?

What will be an ideal response?