Which theory listed below is not one of the process theories discussed in Chapter 5?

a. Equity theory

b. Expectancy theory

c. Goal-setting theory

d. Need theory

d. Need theory

You might also like to view...

Answer the following statements true (T) or false (F)

1.Mortality is lower when social support systems are lacking. 2.We learn the gender roles we perform. 3.When women and men date, men tend to talk more than women. 4.People in healthy relationships respect each other. 5.Our basic needs include exclusion, control, and affection.

In reconciling a bank statement, the bank balance is $2,100, and the checkbook balance is $2,001. Which of the following is the most probable reason for the bank balance being larger than the book balance?

A) There are outstanding checks. B) The bank has deducted certain amounts for bank service charges. C) A deposit in transit was made at the end of the month. D) The company erroneously recorded a check for an amount less than the actual amount.

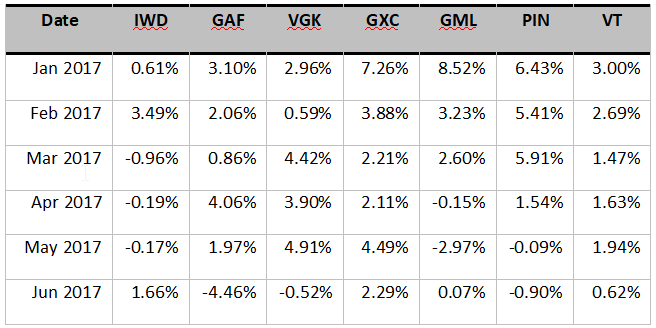

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchange-traded funds (ETFs) that invest in equity market indices of several world regions, including a world equity index, in an attempt to evaluate a well-diversified international portfolio. The regions you have selected are the following: Latin America (GML), Middle East & Africa (GAF), Europe (VGK), China (GXC), India (PIN), U.S. (IWD), and the entire world (VT). You have gathered the monthly returns of these ETFs from January to June 2017. The returns are in the following table:

a) Determine the average returns and standard deviations of each ETF. Also, determine the correlation coefficient and covariance of the American ETF (IWD) with the other ETFs of the rest of the world.

b) Determine the best and worst performer on a risk/return basis during this period. Use the Sharp ratio and assume that the relevant risk-free rate was 3%.

c) What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs except VT (world index ETF)? Are these results similar to those of VT?

d) Using the Solver, what is the minimum standard deviation that could be achieved by combining these ETFs into a portfolio, with the exception of VT? What are the exact weights of these ETFs? Assume short sales are not allowed.

________ data refers to data that is generated in such a way that a logical organization is imposed on it during its generation, thus enabling it to be more readily analyzable for knowledge creation.

A. Unstructured B. Abstract C. Big D. Concrete E. Structured