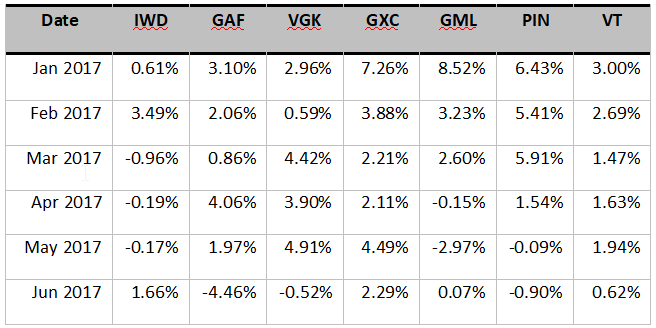

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchange-traded funds (ETFs) that invest in equity market indices of several world regions, including a world equity index, in an attempt to evaluate a well-diversified international portfolio. The regions you have selected are the following: Latin America (GML), Middle East & Africa (GAF), Europe (VGK), China (GXC), India (PIN), U.S. (IWD), and the entire world (VT). You have gathered the monthly returns of these ETFs from January to June 2017. The returns are in the following table:

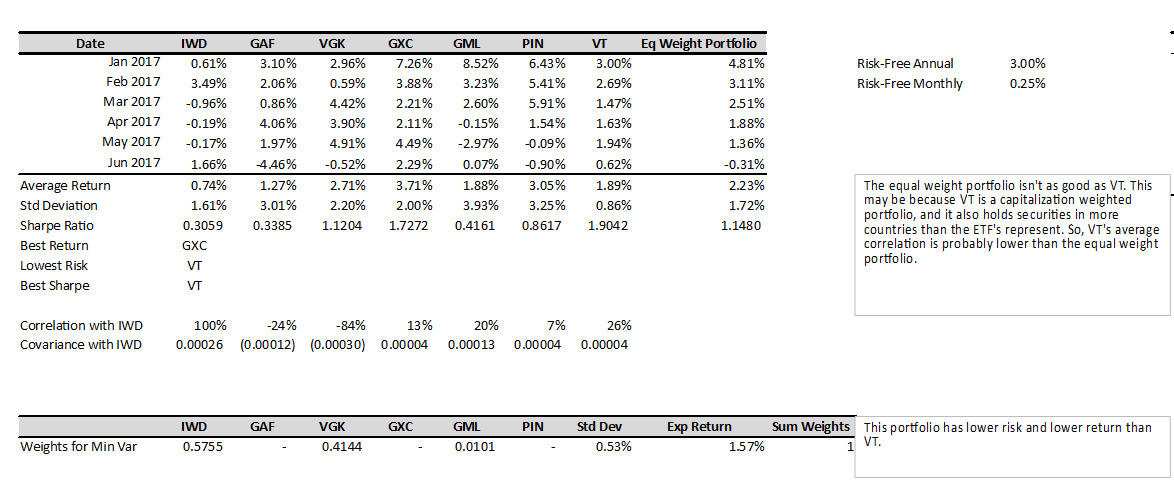

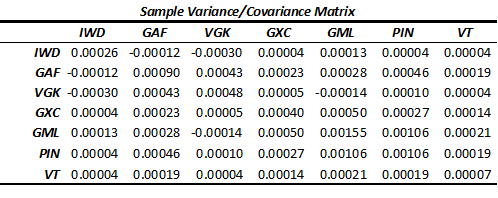

a) Determine the average returns and standard deviations of each ETF. Also, determine the correlation coefficient and covariance of the American ETF (IWD) with the other ETFs of the rest of the world.

b) Determine the best and worst performer on a risk/return basis during this period. Use the Sharp ratio and assume that the relevant risk-free rate was 3%.

c) What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs except VT (world index ETF)? Are these results similar to those of VT?

d) Using the Solver, what is the minimum standard deviation that could be achieved by combining these ETFs into a portfolio, with the exception of VT? What are the exact weights of these ETFs? Assume short sales are not allowed.

You might also like to view...

What is direct examination?

A) inspection and verification of all documents related to a trial by the judge B) inspection and verification of all documents related to a trial by the jurors C) witnesses being questioned by the plaintiff's attorney D) prospective jurors being questioned by the judge or lawyers of each party

When employees are paid more than the maximum of their pay grade, these rates are called

A. green triangle rates. B. red circle rates. C. yellow circle rates. D. blue circle rates.

What are the differences between leaders and managers, according to Zalenik (1977), in the following dimensions: conceptions of work, relations with others, and senses of self?

What will be an ideal response?

Refer to the partial balance sheet above. If on December 31, 2005 Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's market-to-book ratio?

Use the table for the question(s) below. Luther Corporation Consolidated Income Statement Year ended December 31 (in $ millions) 2006 2005 Total sales 610.1 578.3 Cost of sales (500.2) (481.9) Gross profit 109.9 96.4 Selling, general, and administrative expenses (40.5) (39.0) Research and development (24.6) (22.8) Depreciation and amortization (3.6) (3.3) Operating income 41.2 31.3 Other income --- --- Earnings before interest and taxes (EBIT) 41.2 31.3 Interest income (expense) (25.1) (15.8) Pretax income 16.1 15.5 Taxes (5.5) (5.3) Net income 10.6 10.2 Price per share $16 $15 Shares outstanding (millions) 10.2 8.0 Stock options outstanding (millions) 0.3 0.2 Stockholders' Equity 126.6 63.6 Total Liabilities and Stockholders' Equity 533.1 386.7