Consider each of the accounts listed in the table below.Required: Indicate how the balance of each account will be increased and decreased by entering the word "Debit" or "Credit" into the appropriate column. AccountIncreased byDecreased by1)Accounts receivable??2)Service revenue??3)Common stock??4)Cash??5)Salaries expense??6)Notes payable??7)Dividends??8)Prepaid rent??

What will be an ideal response?

| Account | Increased by | Decreased by |

| 1)Accounts receivable | Debit | Credit |

| 2)Service revenue | Credit | Debit |

| 3)Common stock | Credit | Debit |

| 4)Cash | Debit | Credit |

| 5)Salaries expense | Debit | Credit |

| 6)Notes payable | Credit | Debit |

| 7)Dividends | Debit | Credit |

| 8)Prepaid rent | Debit | Credit |

1) Accounts receivable is an asset account.

2) Service revenue is a stockholders' equity account; a credit is used to record an increase in a revenue account since revenues increase net income and stockholders' equity (retained earnings).

3) Common stock is a stockholders' equity account.

4) Cash is an asset account.

5) Salaries expense is a stockholders' equity account; a debit is used to record an increase in an expense account since expenses decrease net income and stockholders' equity (retained earnings).

6) Notes payable is a liability account.

7) Dividends is a stockholders' equity account; a debit is used to record an increase in the dividends account since dividends decrease stockholders' equity (retained earnings).

8) Prepaid rent is an asset account.

You might also like to view...

In the MBO process, employees make the most input into ______ goals.

a. individual b. department-level c. strategic d. financial

Transactions should be written to the log before they are applied to the database itself

Indicate whether the statement is true or false

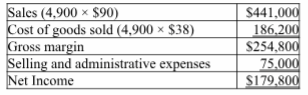

Production costs per tennis racket total $38, which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced). Ten percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Aces, Inc., a manufacturer of tennis rackets, began operations this year. The company

produced 6,000 rackets and sold 4,900. At year-end, the company reported the following income statement using absorption costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

Frank was so entertained by the Paris Symphony on his visit to France that he mailed them a donation of $100 to support their organization as soon as he returned home to Seattle. Frank may deduct the charitable contribution to the Paris Symphony on his U.S. tax return

a. True b. False Indicate whether the statement is true or false