Which of the following is NOT an organizational pattern that would lend itself well to a speech on an event or a person?

a. Topical

b. Spatial

c. Causal

d. Chronological

b. Spatial

You might also like to view...

Which of the following is not a disadvantage of using the direct write-off method for recording uncollectible accounts?

A) Increases the cost of record keeping B) violates the expense recognition principle C) allows manipulation of earnings D) overstates the net realizable value of receivables

A contract in consideration of marriage is necessary only if the promise to marry is other than a(n) ____________________ promise

Fill in the blank(s) with correct word

The concept of wrongful termination of an employee

a. includes tort theory limiting the right of employers to discharge for certain reasons or under certain circumstances. b. is a modern developing common law concept. c. provides some protection for at will employees. d. all of the above

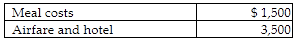

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in attending the conference and taking potential customers to lunch and dinner to discuss book sales.

A) Reimbursement-exclude from income; unreimbursed expenses-no deduction allowed

B) Reimbursement-exclude from income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion

C) Reimbursement-include in income; unreimbursed expenses-no deduction allowed

D) Reimbursement-include in income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion