The Social Security tax is considered to be a

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) marginal tax.

A

You might also like to view...

In the last 40 years, merger policy has become a major way for antitrust authorities to regulate market structure

Indicate whether the statement is true or false

The price elasticity of demand for a monopolist's product depends on

A) the number and similarity of substitutes. B) the ATC of the item it produces. C) the AVC of the item it produces. D) the MC of the item it produces.

What is the present value of a payment of $2,000 to be received two years from today if the interest rate is 5%?

a. $2205 b. $2200 c. $1818.18 d. $1814.06

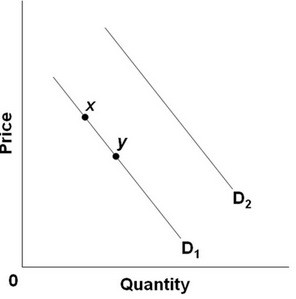

Refer to the above diagram for good X. A shift from D2 to D1 would best be explained by:

Refer to the above diagram for good X. A shift from D2 to D1 would best be explained by:

A. an increase in the price of good X. B. an increase in the price of a complementary good Y. C. an increase in the price of a substitute good Z. D. a decrease in the price of good X.