If an economic action generates more costs than benefits, the action

a. by definition increases the nation's economic welfare.

b. should not be undertaken from an efficiency standpoint.

c. should be subsidized by the government in order to make sure that it is undertaken.

d. is desirable from a public welfare standpoint even though many individuals will be harmed.

B

You might also like to view...

Income and revenue from taxes have a specific relationship during recessions. What is it?

A) incomes fall, tax revenue increases B) incomes rise, tax revenue decreases C) incomes fall, tax revenue decreases D) incomes rise, tax revenue increases

The tax multiplier is most likely to be larger than the expenditure multiplier when ________

A) monetary policy is at the zero lower bound B) rising inflation causes the real interest rate to decline C) when the change in tax revenue is large relative to the change in government purchases D) the expansionary fiscal policy is expected to be followed by higher taxes

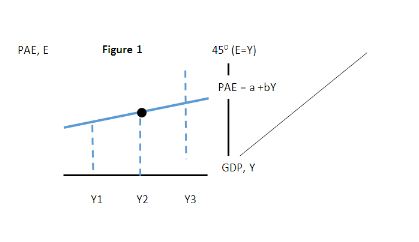

In Figure 1 below if the economy were at Y2 then we would expect there to be:

A. a reduction in inventories.

B. an increase in inventories.

C. no change in inventories.

D. an increase in consumption spending.

A sunk cost is one that

a. changes as the level of output changes in the short run b. was paid in the past and will not change regardless of later decisions c. should determine the rational course of action in the future d. has the most impact on profit-maximizing decisions e. influences rational decision makers