The tax multiplier is most likely to be larger than the expenditure multiplier when ________

A) monetary policy is at the zero lower bound

B) rising inflation causes the real interest rate to decline

C) when the change in tax revenue is large relative to the change in government purchases

D) the expansionary fiscal policy is expected to be followed by higher taxes

D

You might also like to view...

"Price discrimination allows a monopolist to increase his or her economic profits by capturing part of the consumer surplus and turning it into economic profit

" Is the previous statement correct or incorrect? If the statement is correct, why is it important in understanding firms' behaviors? If it is incorrect, why is it incorrect?

When comparing partial-equilibrium effects to general-equilibrium effects, one can conclude that

A) general-equilibrium effects are always larger. B) partial-equilibrium effects are always larger. C) the effects are of equal size. D) one cannot determine before the fact which effect is greater.

The value added at all stages of production sums to the market value of the final good, and the value added for all final goods sums to GDP based on the income approach

a. True b. False Indicate whether the statement is true or false

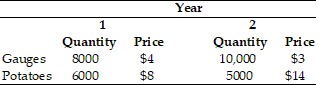

The country of Myrule has produced the following quantity of gauges and potatoes, with the price of each listed in dollar terms. (a)Using Year 1 as the base year, what is the growth rate of real GDP from Year 1 to Year 2? (b)Based on the GDP deflator, what is the inflation rate from Year 1 to Year 2?

(a)Using Year 1 as the base year, what is the growth rate of real GDP from Year 1 to Year 2? (b)Based on the GDP deflator, what is the inflation rate from Year 1 to Year 2?

What will be an ideal response?