How much can Deborah deduct in taxes as itemized deductions?

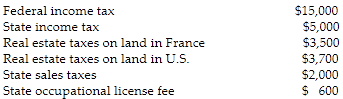

During the current year, Yvonne, a single individual, paid the following amounts:

$5,000 + 3,500 + 3,700 = $12,200 potential itemized deduction for taxes, but the deduction is limited to $10,000. The taxpayer may deduct the greater of state and local income taxes or sales taxes.

You might also like to view...

Describe how advertising objectives are set to reflect the product class

What will be an ideal response?

Advantages of CATI include:

A) interviews can be conducted via TV cable B) cable and TV interviewing may be conducted simultaneously C) surveys can be enhanced with the CATI drop-off survey technique D) the computer dials the respondent, brings up the questions to the interviewer and moves ahead to the appropriate question E) CATI enhances single source data

Define the meaning of "ethos."

The UNFCCC works on the "cap-and-trade" principle

Indicate whether the statement is true or false