Jaxon borrows $10,000 from a bank and withdraws $20,000 from his personal savings to open a tattoo parlor. The interest rate is 3 percent for both the bank loan and his personal savings. Jaxon also quit his job as a waiter, which paid $20,000 . According to an economist, Jaxon's opportunity cost of opening the tattoo parlor equals $20,900

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Gross domestic product is calculated by summing up

A) the total market value of goods and services in the economy. B) the total quantity of goods and services produced in the economy during a period of time. C) the total quantity of goods and services in the economy. D) the total market value of final goods and services produced in the economy during a period of time.

Assume the demand for cigarettes is relatively inelastic, and the supply of cigarettes is relatively elastic. When cigarettes are taxed, we would expect

a. most of the burden of the tax to fall on sellers of cigarettes, regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government. b. most of the burden of the tax to fall on buyers of cigarettes, regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government. c. the distribution of the tax burden between buyers and sellers of cigarettes to depend on whether buyers or sellers of cigarettes are required to pay the tax to the government. d. a large percentage of smokers to quit smoking in response to the tax.

What is likely to occur over the long run if it is easy for new firms to enter an oligopolistic industry?

a. The general level of prices will begin to approach average total cost. b. The general level of prices will rise well above average total cost. c. It will become easier for a cartel to form consensus about pricing decisions. d. The industry will become more oligopolistic and could trigger an antitrust probe.

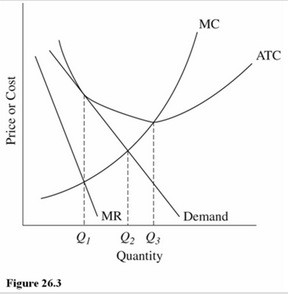

Refer to Figure 26.3 for a monopolistically competitive firm in the long run. Which of the following observations results in the problem of excess capacity?

Refer to Figure 26.3 for a monopolistically competitive firm in the long run. Which of the following observations results in the problem of excess capacity?

A. The firm is producing at Q3 instead of where MR = MC. B. The firm is producing at Q1 instead of where MC = demand. C. The firm is producing less than the minimum-ATC output rate. D. The firm is earning only zero economic profits in the long run.