An individual has preferences consistent with prospect theory. The person takes their current wealth of $10,000 (plus any certain additions) as their reference point. Gains above this reference point are worth +1 util. Losses below this reference point are worth -2 utils. The person is faced with two choice problems. The first involves a choice between (A) no gamble and (B) a gamble with an equal

chance of winning $1,800 and losing $1,000 . The second choice problem, the person first has $1,000 taken away (resulting in the adjustment of the reference point). The choice is then between (C) being given back $1,000 for sure and (D) an equal chance of winning $2,800 or nothing. What choices would the person make?

a. A and C.

b. A and D.

c. B and C.

d. B and D.

b

You might also like to view...

Market clearing means

A) quantity demanded exceeds quantity supplied. B) quantity demanded equals quantity supplied. C) quantity demanded is less than quantity supplied. D) quantity demanded and quantity supplied both equal zero.

What are the problem with Medicare and Medicaid?

What will be an ideal response?

An aggregate supply curve that is a vertical line must be:

A. a short-run curve. B. a long-run curve. C. an individual firm's supply curve. D. an individual industry's supply curve.

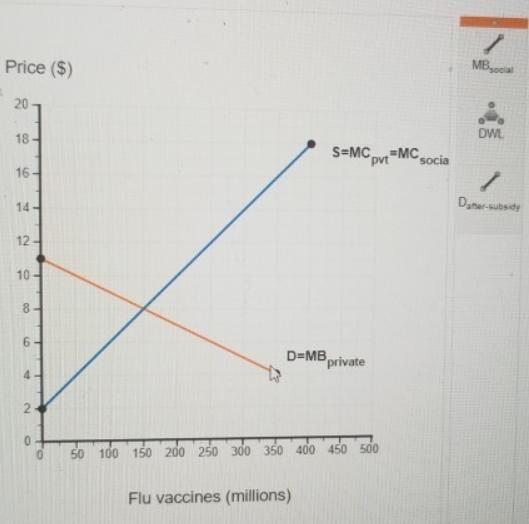

The figure below shows private supply and demand for flu vaccines.