Write the rate as a simplified fraction. Then write the rate in word form.335 miles in 30 hours

A.

335 miles for every 6 hours

B.

67 hours for every 6 miles

C.

67 miles for every 6 hours

D.

67 miles for every 30 hours

Answer: C

You might also like to view...

Carry out the indicated operation and give your answer with the specified number of significant digits.(9.1 × 109) ÷ (3.2 × 10-5); 2 significant digits

A. 2.84 × 1014 B. 3 × 1014 C. 2.8 × 1014 D. 2.8 × 104

Convert the numeral to Egyptian form.1011

A. ![]()

![]()

![]()

B. ![]()

![]()

![]()

C. ![]()

![]()

![]()

D. ![]()

![]()

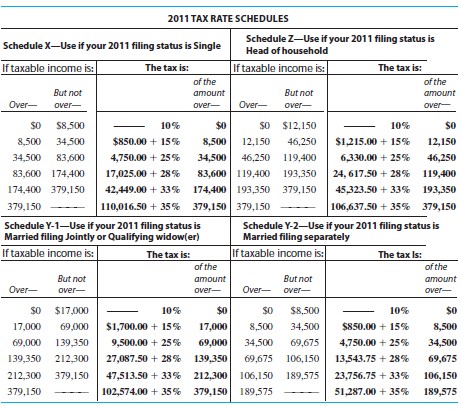

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Megan Cortez had an adjusted gross income of $51,453 last year. She had deductions of $886 for state income tax, $570 for property tax, $3809 in mortgage interest, and $605 in contributions. Cortez claims one exemption and files as a single person.

Megan Cortez had an adjusted gross income of $51,453 last year. She had deductions of $886 for state income tax, $570 for property tax, $3809 in mortgage interest, and $605 in contributions. Cortez claims one exemption and files as a single person.

A. $7520.75 B. $6595.75 C. $8063.25 D. $8988.25

Identify the conic that the polar equation represents. Also, give the position of the directrix.r =

A. ellipse, directrix parallel to the polar axis  above the pole

above the pole

B. ellipse, directrix perpendicular to the polar axis  left of the pole

left of the pole

C. ellipse, directrix parallel to the polar axis  below the pole

below the pole

D. ellipse, directrix perpendicular to the polar axis  right of the pole

right of the pole